Author has posted a follow up to this post here.

L&L Energy, Inc, (NASDAQ: LLEN) is in the business of coal mining, washing, coking, and wholesaling. Although its operations are conducted in China, the company is headquartered in Seattle, WA. As of 5/20/11, the company had a market cap of $200 MM.

The stock has been volatile, and although off significantly from its 2010 highs, the stock is still up over 200% from its 2009 debut.

The company claims an impressive growth record.

It also has questionable accounting, puzzling acquisitions, and checkered senior management.

Today in part 1 of this series I am going to discuss the accounting irregularities I have found.

Accounting Irregularities

L&L’s SEC filings are riddled with accounting red flags, which is even more alarming as the CEO is a CPA, and the filings claim their business strategy is to “assign our US trained management team, including CPAs from the Seattle office to monitor and control the coal operations.”

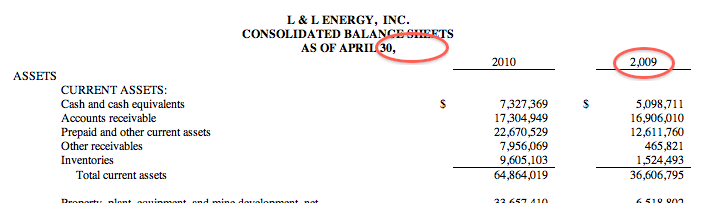

Below is the actual balance sheet as reported on the 2010 10-K. Notice how the title omits the year, and 2009 is formatted as 2,009. The latter happens to me all the time… when I am creating a spreadsheet from scratch and excel assumes 2009 is the number 2,009 instead of the year.

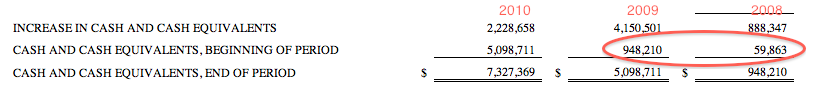

Below is a portion of the statement of cash flows, as presented in the 2010 10-K:

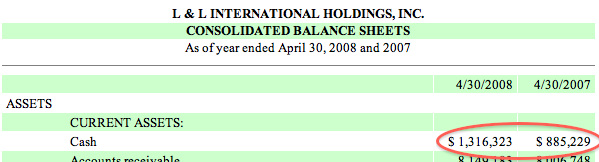

Notice the “beginning of period” cash balances provided for 2009 and 2008, and compare them to the figures on the Balance Sheet as reported in the 2008 10-K:

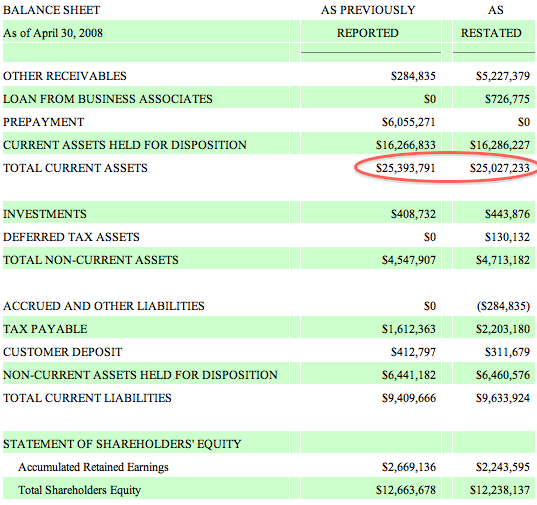

To be fair, L&L did restate their 2008 results, but there was no mention of the cash restatement. The full disclosure in the 2009 10-K is as follows:

Subsequent to the issuance of the Company’s financial statements for the year ended April 30, 2008, the management of the Company determined that certain transactions and presentation in the financial statements for the year ended April 30, 2008 had not been accounted for properly.

Management became aware that there was more VAT tax payable in addition to what was recorded and reflected in the financial statements as of April 30, 2008. VAT tax payable was understated by $590,817 as of April 30, 2008. In addition, Management also determined that certain items in balance sheets of the Company as on April 30, 2008 were not properly classified in accordance with the US GAAP, specifically the allowance for bad debts.

The Company has restated its financial statements by recording the accrual for VAT taxes and bad debt allowance expenses, and reclassification as of April 30, 2008.

The effect of the correction of presentation is as follows:

The above constitutes the entire disclosure in the 2009 10-K.

No mention that the CASH at year end 2008 and 2007 was restated 28% and 93% lower than originally reported, respectively.

No disclosure that 2008 REVENUES were revised down by 27%, or that 2008 NET INCOME was revised down by 30%.

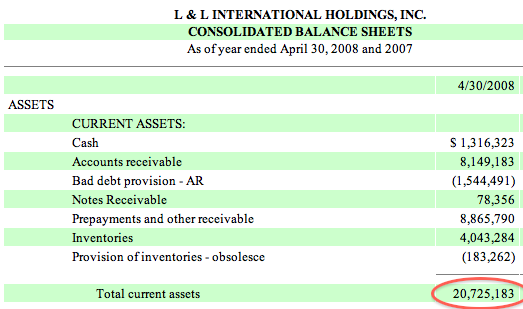

Note also that the restated balance sheet lists previously stated “total current assets” at $25,393,791, while the actual balance sheet as reported in 2008 (shown below) lists total current assets as $20,725,183.

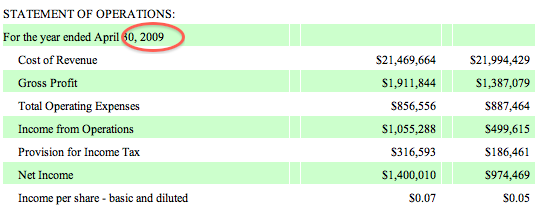

Also notice that the restated “statement of operations” incorrectly calls it a statement for the year ended April 30, 2009 instead of 2008.

But most troubling is the cash discrepancy.

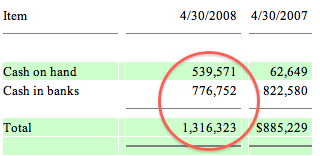

The 2008 10-K provided the following cash detail:

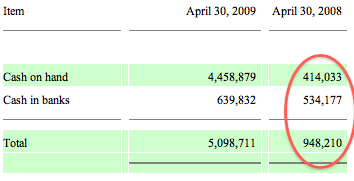

And the 2009 10-K provided the following (which are the restated balances):

Notice again the restatement of the 2008 cash balance, which was quietly ignored in the restatement disclosure. Note that the restatement even includes a restatement of the cash balance LLEN claims as “cash in banks.”

Also notice that the 2009 cash balance of over $5 MM includes a surge to $4.5 MM of “cash on hand,” as distinguished from “cash in banks.” I guess this means they have suitcases full of cash.

I hope the auditor brought a money counter…

Auditing

Speaking of the auditor, don’t count of them to verify the books.

The company is audited by Kabani & Company, Inc of Los Angeles. In a July 2010 inspection, the Public Company Accounting Oversight Board (PCAOB) reviewed Kabani’s audit of 8 different issuers. According to the report, the PCAOB “identified in 5 of the audits reviewed [sic], deficiencies of such significance that it appeared to the inspection team that the Firm did not obtain sufficient competent evidential matter to support its opinion on the issuer’s financial statements.”

These deficiencies included failures to properly address:

- in 2 of the 8 audits, departures from GAAP related to the treatment of minority interest

- the reporting of a disposal group held for sale and discontinued operations

- in 2 of the 8 audits, revenue testing

- the functional currency of a consolidated subsidiary

- valuation of acquired patents

- failure to test whether advance payments represented probable future economic benefits

Summary

Alarming as this is, it is far from the only reason to have concerns about L&L Energy. I’ll be back soon to discuss the other giant red flags at this company.

Author Disclosure: Author has plans to enter a short position and/or purchase put options in L&L Energy at the time of writing.

9 Responses to Accounting Irregularities at L&L Energy